Other AI Tools and Use Cases, Conclusion, and the Future of ChatGPT and Other AI Models in Tax Assessment

Concluding our session on ChatGPT's transformative role in tax assessment, it's pivotal to stress the importance of security and data privacy. Though AI systems, like ChatGPT, offer immense benefits, they also come with inherent risks. It's our duty to consistently uphold stringent security measures, data audits, and maintain rigorous privacy norms.

Through our discussions, we've seen ChatGPT's unmatched potential for tax assessment. It processes vast data with unparalleled speed and accuracy, serving as a prime tool. While AI is designed to be accurate, it's essential to note that errors, though rare, can occur.

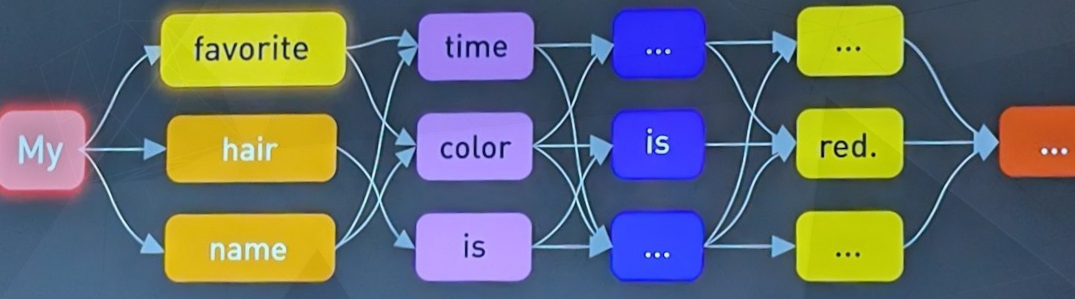

We're entering an era where AI transitions from merely assisting to partnering. AI models like ChatGPT excel in automating routine tasks, allowing us to concentrate on intricate, strategic challenges. Echoing Chris Lattner's sentiments, our growth is via delegation. Delegating responsibilities to AI greatly amplifies our efficiency, notably in tax assessment.

As the horizon of AI in tax assessment expands, staying updated with emerging trends is crucial. Adapting, learning, and embracing these novelties will determine our success. The key lies in our readiness to incorporate AI seamlessly, understand its nuances, and pledge to its ethical use.

In summary, AI models, especially ChatGPT, can be revolutionary in the tax domain, enhancing our accuracy and efficiency. As we proceed on this promising journey, our focus should always be on security, ethical use, and data privacy.

Your attention and participation have been invaluable. Thank you.